tax strategies for high-income earners 2020

Read customer reviews find best sellers. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Search Q 2020 Vs 2021 Tax Brackets Tbm Isch

Qualified Charitable Distributions QCD.

. Currently there will be a 12 deduction for a single person in 2020. Creating retirement accounts is one of the great tax reduction strategies for high income earners. We provide guidance at critical junctures in your personal and professional life.

Ad Holistic approaches to wealth management including tax planning and goal setting. Third you reduce your tax burden. All contributions that you make are tax-deductible.

And things are about to get worse if President Biden gets his way. Ad Make Tax-Smart Investing Part of Your Tax Planning. Maximize Tax Credits 41 Make the Most of It 5 5.

A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses. First you give to a charity which helps the charity and likely makes you feel good. Charitable Donations When you.

You can also read our guide on 7 secrets to high net worth investment management estate tax and financial planning. Tax strategies for high-income earners 2020. Connect With a Fidelity Advisor Today.

Ad Tax Strategies that move you closer to your financial goals and objectives. There are seven tax brackets for most ordinary income for the 2021 tax year. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners.

Do a 1031 Exchange 61 Make the Most of It 7 7. Browse discover thousands of brands. Increase Charitable Donations 51 Make the Most of It 6 6.

If theres potential for a high return by. Second you meet your required withdrawal for the year. The Tax Cuts and Jobs Act TCJA signed into law December 2017 and implemented in 2018 is currently set to sunset after 2025.

How to Reduce Taxable Income. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. We recommend doing a trial tax return before year-end to assess your tax implications thus allowing for current year action to maximize tax opportunities.

In fact Bonsai Tax can help. As shown below deductions nearly. Connect With a Fidelity Advisor Today.

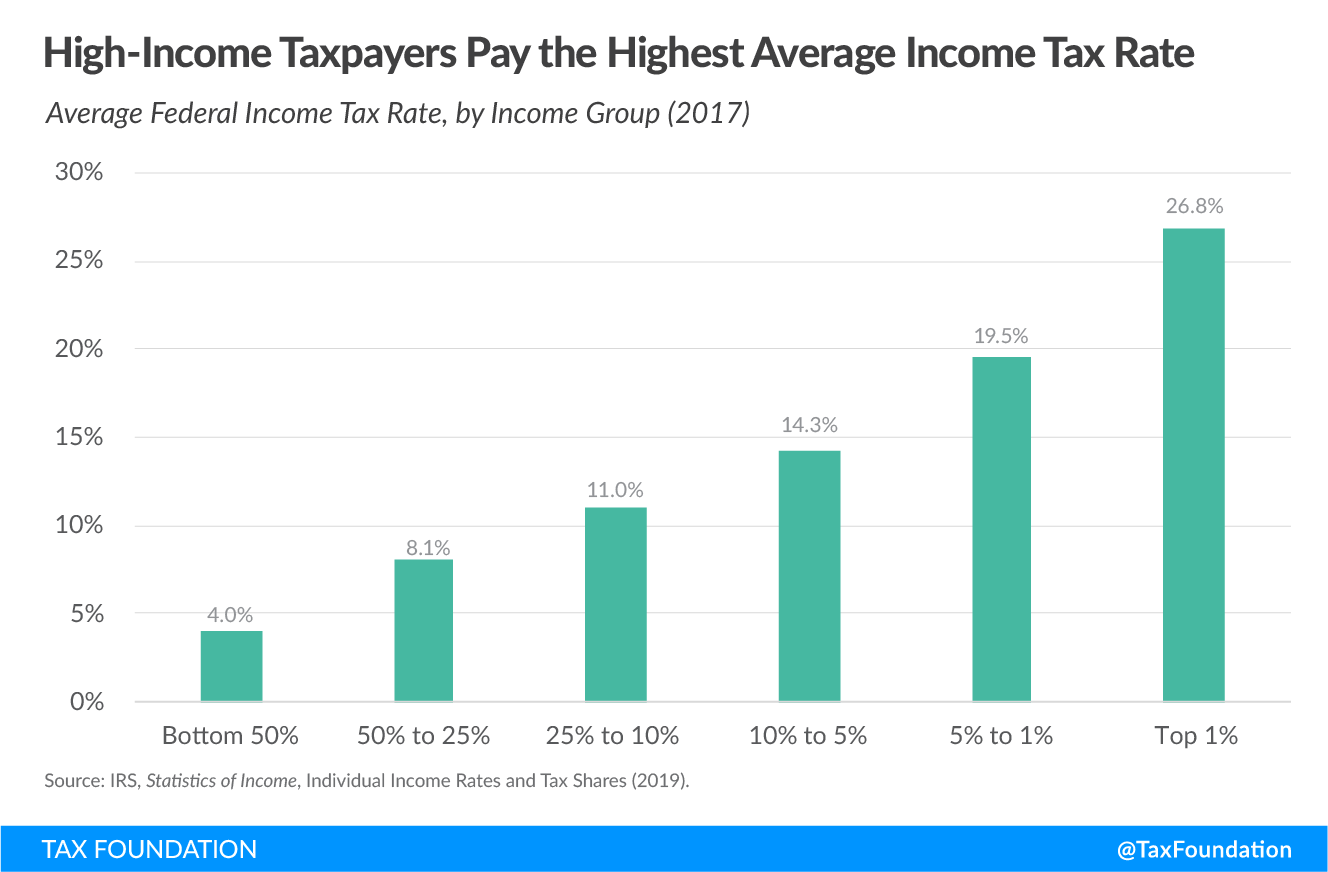

The current top marginal tax rate in the US is 37. Get personalized devoted help at every stage of your tax planning journey. 1 Ad Make Tax-Smart Investing.

6 Tax Strategies for High Net Worth Individuals 1. The law permits you to deduct the amount you deposit into a tax-certified. So high-income earners find collecting several properties and carrying mortgages less than 750000 offers tax advantages.

Thats especially true if you earn more than 400000. If youre over 55 you. Our tax receipt scanner app will.

The required minimum distributions RMDs age was increased from 70-12 to 72 in 2020. Washington State recently enacted a tax on extraordinary profits from the sale of financial. Trial Tax Return.

As of 2020 you can contribute up to 3500 per year as an individual or up to 7100 on behalf of your family. Nevertheless if you hit 70-12 in 2019 you still had to begin taking RMDs in 2020. The average annual amount will be 25900 if married filing jointly or the maximum of 5 for those who are.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more.

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

What You Need To Know About 2020 Taxes Advisors Management Group

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

What Are Marriage Penalties And Bonuses Tax Policy Center

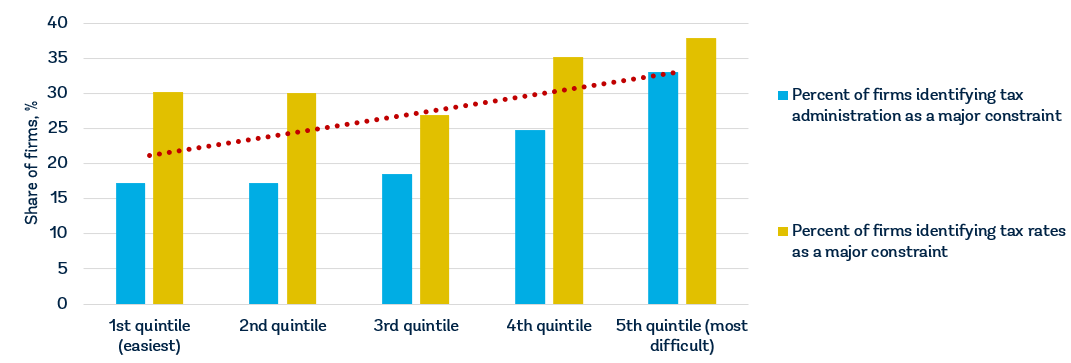

Why It Matters In Paying Taxes Doing Business World Bank Group

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

Millionaires And High Income Earners Tax Foundation

![]()

Tax Time Preparation For 2020 Tax Time Online Taxes Tax Refund

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Time Preparation For 2020 Tax Time Online Taxes Tax Refund